import pandas as np

import numpy as np

import tensorflow as tf

import tensorflow_probability as tfp

import matplotlib.pyplot as plt

from datetime import timedelta

import pandas as pdMultivariate GARCH in Tensorflow/Keras

Not investment advice - use at your own risk.

Conditional volatility and correlation using multivariate GARCH on DAX and S&P500. Implementation with Tensorflow/Keras.

Still under development - corresponding blogpost coming soon.

import yfinance as yf

data = yf.download("^GDAXI ^GSPC", start="2017-09-10", end="2022-09-10", interval="1d")

close = data["Close"]

returns = np.log(close).diff().dropna()

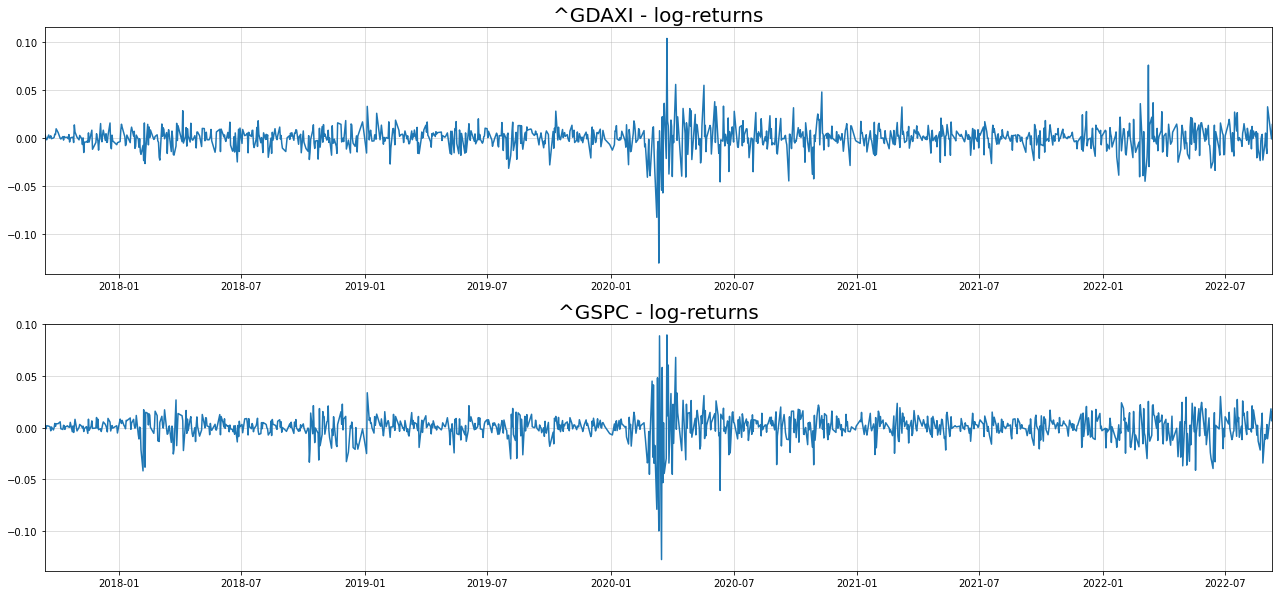

fig, axs = plt.subplots(2,1, figsize = (22,5*2))

for i in range(2):

axs[i].plot(returns.iloc[:,i])

axs[i].grid(alpha=0.5)

axs[i].margins(x=0)

axs[i].set_title("{} - log-returns".format(returns.columns[i]),size=20)[*********************100%***********************] 2 of 2 completed

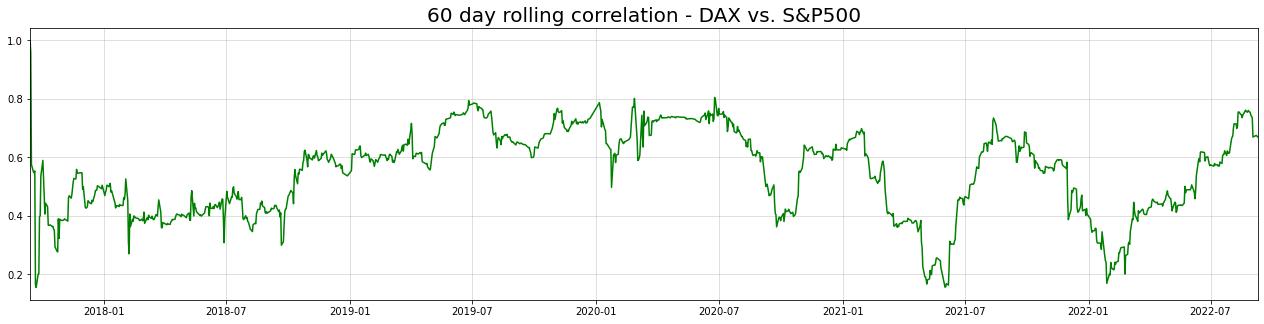

rolling_corrs = returns.rolling(60,min_periods=0).corr()

gdaxi_sp500_rollcorr = rolling_corrs["^GDAXI"][rolling_corrs.index.get_level_values(1)=="^GSPC"]

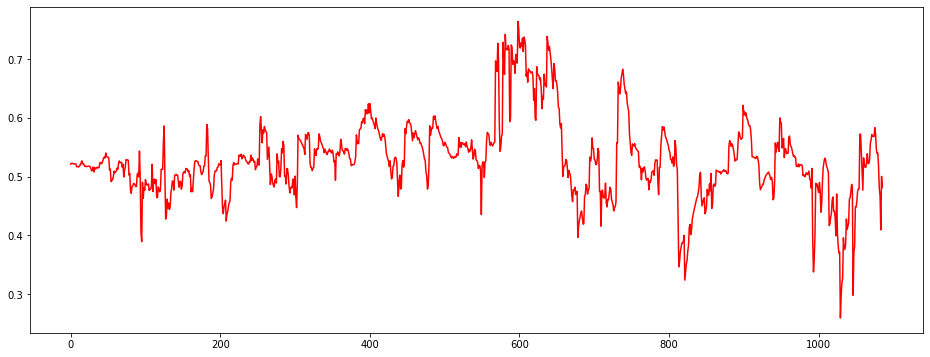

plt.figure(figsize = (22,5))

plt.title("60 day rolling correlation - DAX vs. S&P500",size=20)

plt.plot(returns.index[30:],gdaxi_sp500_rollcorr.values[30:],c="green", label="60 day rolling correlation")

plt.grid(alpha=0.5)

plt.margins(x=0)

class MGARCH_DCC(tf.keras.Model):

"""

Tensorflow/Keras implementation of multivariate GARCH under dynamic conditional correlation (DCC) specification.

Further reading:

- Engle, Robert. "Dynamic conditional correlation: A simple class of multivariate generalized autoregressive conditional heteroskedasticity models."

- Bollerslev, Tim. "Modeling the Coherence in Short-Run Nominal Exchange Rates: A Multi-variate Generalized ARCH Model."

- Lütkepohl, Helmut. "New introduction to multiple time series analysis."

"""

def __init__(self, y):

"""

Args:

y: NxM numpy.array of N observations of M correlated time-series

"""

super().__init__()

n_dims = y.shape[1]

self.n_dims = n_dims

self.MU = tf.Variable(np.mean(y,0)) #use a mean variable

self.sigma0 = tf.Variable(np.std(y,0)) #initial standard deviations at t=0

#we initialize all restricted parameters to lie inside the desired range

#by keeping the learning rate low, this should result in admissible results

#for more complex models, this might not suffice

self.alpha0 = tf.Variable(np.std(y,0))

self.alpha = tf.Variable(tf.zeros(shape=(n_dims,))+0.25)

self.beta = tf.Variable(tf.zeros(shape=(n_dims,))+0.25)

self.L0 = tf.Variable(np.float32(np.linalg.cholesky(np.corrcoef(y.T)))) #decomposition of A_0

self.A = tf.Variable(tf.zeros(shape=(1,))+0.9)

self.B = tf.Variable(tf.zeros(shape=(1,))+0.05)

def call(self, y):

"""

Args:

y: NxM numpy.array of N observations of M correlated time-series

"""

return self.get_conditional_dists(y)

def get_log_probs(self, y):

"""

Calculate log probabilities for a given matrix of time-series observations

Args:

y: NxM numpy.array of N observations of M correlated time-series

"""

return self.get_conditional_dists(y).log_prob(y)

@tf.function

def get_conditional_dists(self, y):

"""

Calculate conditional distributions for given observations

Args:

y: NxM numpy.array of N observations of M correlated time-series

"""

T = tf.shape(y)[0]

#create containers for looping

mus = tf.TensorArray(tf.float32, size = T) #observation mean container

Sigmas = tf.TensorArray(tf.float32, size = T) #observation covariance container

sigmas = tf.TensorArray(tf.float32, size = T+1)

us = tf.TensorArray(tf.float32, size = T+1)

Qs = tf.TensorArray(tf.float32, size = T+1)

#initialize respective values for t=0

sigmas = sigmas.write(0, self.sigma0)

A0 = tf.transpose(self.L0)@self.L0

Qs = Qs.write(0, A0) #set initial unnormalized correlation equal to mean matrix

us = us.write(0, tf.zeros(shape=(self.n_dims,))) #initial observations equal to zero

#convenience

sigma0 = self.sigma0

alpha0 = self.alpha0**2 #ensure positivity

alpha = self.alpha

beta = self.beta

A = self.A

B = self.B

for t in tf.range(T):

#tm1 = 't minus 1'

#suppress conditioning on past in notation

#1) calculate conditional standard deviations

u_tm1 = us.read(t)

sigma_tm1 = sigmas.read(t)

sigma_t = (alpha0 + alpha*sigma_tm1**2 + beta*u_tm1**2)**0.5

#2) calculate conditional correlations

u_tm1_standardized = u_tm1/sigma_tm1

Psi_tilde_tm1 = tf.reshape(u_tm1_standardized, (self.n_dims,1))@tf.reshape(u_tm1_standardized, (1,self.n_dims))

Q_tm1 = Qs.read(t)

Q_t = A0 + A*(Q_tm1 - A0) + B*(Psi_tilde_tm1 - A0)

R_t = self.cov_to_corr(Q_t)

#3) calculate conditional covariance

D_t = tf.linalg.LinearOperatorDiag(sigma_t)

Sigma_t = D_t@R_t@D_t

#4) store values for next iteration

sigmas = sigmas.write(t+1, sigma_t)

us = us.write(t+1, y[t,:]-self.MU) #we want to model the zero-mean disturbances

Qs = Qs.write(t+1, Q_t)

mus = mus.write(t, self.MU)

Sigmas = Sigmas.write(t, Sigma_t)

return tfp.distributions.MultivariateNormalFullCovariance(mus.stack(), Sigmas.stack())

def cov_to_corr(self, S):

"""

Transforms covariance matrix to a correlation matrix via matrix operations

Args:

S: Symmetric, positive semidefinite covariance matrix (tf.Tensor)

"""

D = tf.linalg.LinearOperatorDiag(1/(tf.linalg.diag_part(S)**0.5))

return D@S@D

def train_step(self, data):

"""

Custom training step to handle keras model.fit given that there is no input-output structure in our model

Args:

S: Symmetric, positive semidefinite covariance matrix (tf.Tensor)

"""

x,y = data

with tf.GradientTape() as tape:

loss = -tf.math.reduce_mean(self.get_log_probs(y))

trainable_vars = self.trainable_weights

gradients = tape.gradient(loss, trainable_vars)

self.optimizer.apply_gradients(zip(gradients, trainable_vars))

return {"Current loss": loss}

def sample_forecast(self, y, T_forecast = 30, n_samples=500):

"""

Create forecast samples to use for monte-carlo simulation of quantities of interest about the forecast (e.g. mean, var, corr, etc.)

WARNING: This is not optimized very much and can take some time to run, probably due to Python's slow loops - can likely be improved

Args:

y: numpy.array of training data, used to initialize the forecast values

T_forecast: number of periods to predict (integer)

n_samples: Number of samples to draw (integer)

"""

T = tf.shape(y)[0]

#create lists for looping; no gradients, thus no tf.TensorArrays needed

#can initialize directly

mus = []

Sigmas = []

us = [tf.zeros(shape=(self.n_dims,))]

sigmas = [self.sigma0]

Qs = []

#initialize remaining values for t=0

A0 = tf.transpose(self.L0)@self.L0

Qs.append(A0)

#convenience

sigma0 = self.sigma0

alpha0 = self.alpha0**2 #ensure positivity

alpha = self.alpha

beta = self.beta

A = self.A

B = self.B

#'warmup' to initialize latest lagged features

for t in range(T):

#tm1 = 't minus 1'

#suppress conditioning on past in notation

u_tm1 = us[-1]

sigma_tm1 = sigmas[-1]

sigma_t = (alpha0 + alpha*sigma_tm1**2 + beta*u_tm1**2)**0.5

u_tm1_standardized = u_tm1/sigma_tm1

Psi_tilde_tm1 = tf.reshape(u_tm1_standardized, (self.n_dims,1))@tf.reshape(u_tm1_standardized, (1,self.n_dims))

Q_tm1 = Qs[-1]

Q_t = A0 + A*(Q_tm1 - A0) + B*(Psi_tilde_tm1 - A0)

R_t = self.cov_to_corr(Q_t)

D_t = tf.linalg.LinearOperatorDiag(sigma_t)

Sigma_t = D_t@R_t@D_t

sigmas.append(sigma_t)

us.append(y[t,:]-self.MU) #we want to model the zero-mean disturbances

Qs.append(Q_t)

mus.append(self.MU)

Sigmas.append(Sigma_t)

#sample containers

y_samples = []

R_samples = []

sigma_samples = []

for n in range(n_samples):

mus_samp = []

Sigmas_samp = []

sigmas_samp = [sigmas[-1]]

us_samp = [us[-1]]

Qs_samp = [Qs[-1]]

#forecast containers

ys_samp = []

sig_samp = []

R_samp = []

for t in range(T_forecast):

u_tm1 = us_samp[-1]

sigma_tm1 = sigmas_samp[-1]

sigma_t = (alpha0 + alpha**2 + beta*u_tm1**2)**0.5

u_tm1_standardized = u_tm1/sigma_tm1

Psi_tilde_tm1 = tf.reshape(u_tm1_standardized, (self.n_dims,1))@tf.reshape(u_tm1_standardized, (1,self.n_dims))

Q_tm1 = Qs_samp[-1]

Q_t = A0 + A*(Q_tm1 - A0) + B*(Psi_tilde_tm1 - A0)

R_t = self.cov_to_corr(Q_t)

D_t = tf.linalg.LinearOperatorDiag(sigma_t)

Sigma_t = D_t@R_t@D_t

sigmas_samp.append(sigma_t)

Qs_samp.append(Q_t)

ynext = tfp.distributions.MultivariateNormalFullCovariance(self.MU, Sigma_t).sample()

ys_samp.append(tf.reshape(ynext,(1,1,-1)))

sig_samp.append(tf.reshape(sigma_t,(1,1,-1)))

R_samp.append(tf.reshape(R_t,(1,1,self.n_dims,self.n_dims)))

us_samp.append(ynext-self.MU)

y_samples.append(tf.concat(ys_samp,1))

R_samples.append(tf.concat(R_samp,1))

sigma_samples.append(tf.concat(sig_samp,1))

return tf.concat(y_samples,0).numpy(), tf.concat(R_samples,0).numpy(), tf.concat(sigma_samples,0).numpy()train = np.float32(returns)[:-90,:]

test = np.float32(returns)[-90:,:]model = MGARCH_DCC(train)

from scipy.stats import norm

out = model(train)

means = out.mean().numpy()

stds = out.stddev().numpy()

lowers = norm(means, stds).ppf(0.05)

uppers = norm(means, stds).ppf(0.95)

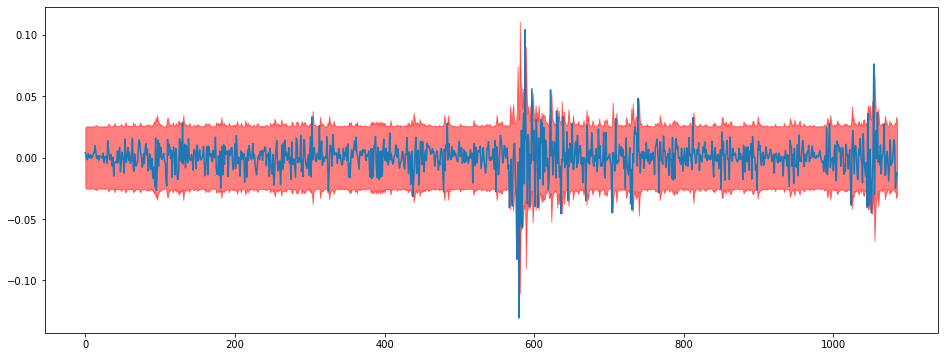

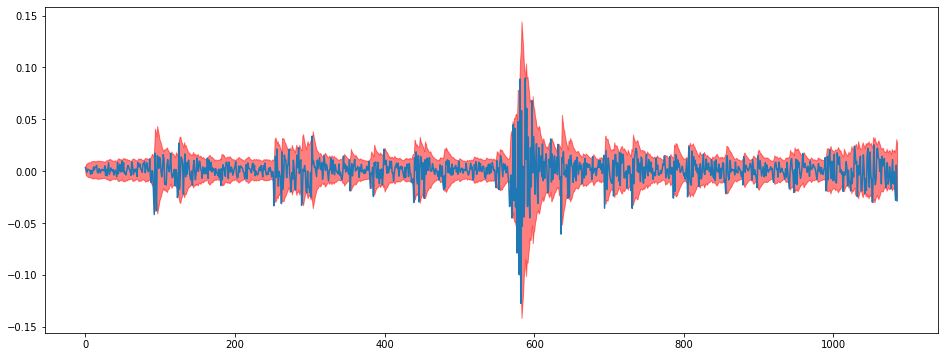

plt.figure(figsize = (16,6))

i = 0

plt.figure(figsize = (16,6))

plt.plot(train[:,i])

plt.fill_between(np.arange(len(train)),lowers[:,i],uppers[:,i],color="red",alpha=0.5)<Figure size 1152x432 with 0 Axes>

plt.figure(figsize = (16,6))

corr12 = [model.cov_to_corr(out.covariance()[i,:,:])[0,1].numpy() for i in range(len(train))]

plt.plot(corr12,c="red")

i = 1

plt.figure(figsize = (16,6))

plt.plot(train[:,i])

plt.fill_between(np.arange(len(train)),lowers[:,i],uppers[:,i],color="red",alpha=0.5)

model.compile(optimizer=tf.keras.optimizers.Adam(learning_rate=1e-2))model.fit(train, train, batch_size=len(train), shuffle=False, epochs = 300, verbose=False)<keras.callbacks.History at 0x137bf2a40>out = model(train)

means = out.mean().numpy()

stds = out.stddev().numpy()

lowers = norm(means, stds).ppf(0.05)

uppers = norm(means, stds).ppf(0.95)i = 0

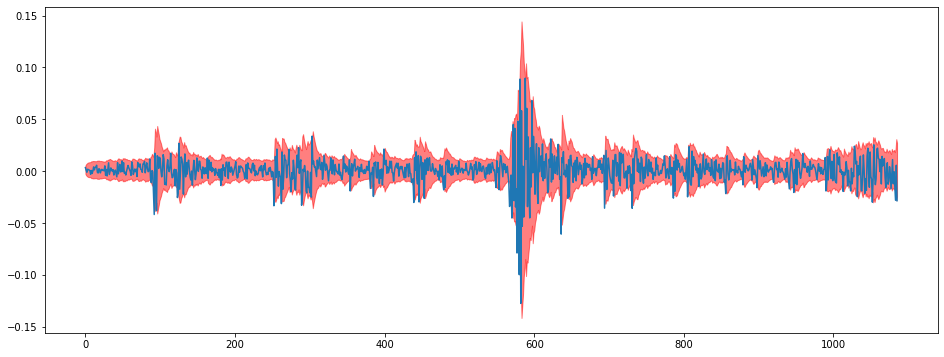

plt.figure(figsize = (16,6))

plt.plot(train[:,i])

plt.fill_between(np.arange(len(train)),lowers[:,i],uppers[:,i],color="red",alpha=0.5)

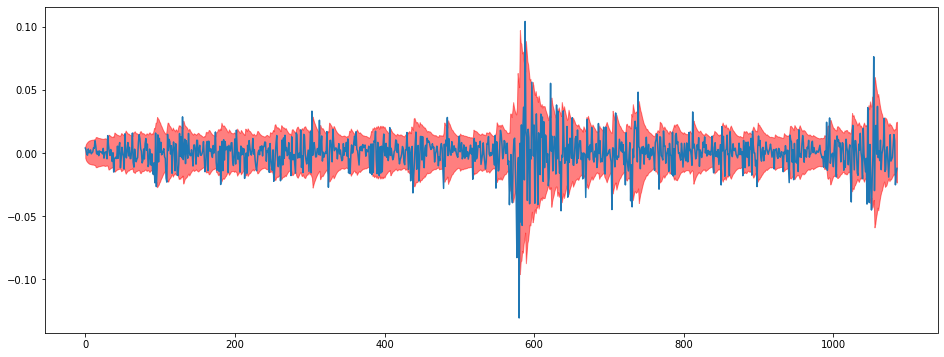

i = 1

plt.figure(figsize = (16,6))

plt.plot(train[:,i])

plt.fill_between(np.arange(len(train)),lowers[:,i],uppers[:,i],color="red",alpha=0.5)

corr12 = [model.cov_to_corr(out.covariance()[i,:,:])[0,1].numpy() for i in range(len(train))]np.random.seed(123)

tf.random.set_seed(123)

fcast = model.sample_forecast(train,90,1000)corrs = fcast[1][:,:,0,1]

corr_means = np.mean(corrs,0)

corr_lowers = np.quantile(corrs,0.05,0)

corr_uppers = np.quantile(corrs,0.95,0)

conditional_dists = model(np.float32(returns.values))

conditional_correlations = [model.cov_to_corr(conditional_dists.covariance()[i,:,:])[0,1].numpy() for i in range(len(returns))]

idx_train = returns[:-90].index

idx_test = pd.date_range(returns[:-90].index[-1] + timedelta(days=1), returns[:-90].index[-1] + timedelta(days=90))

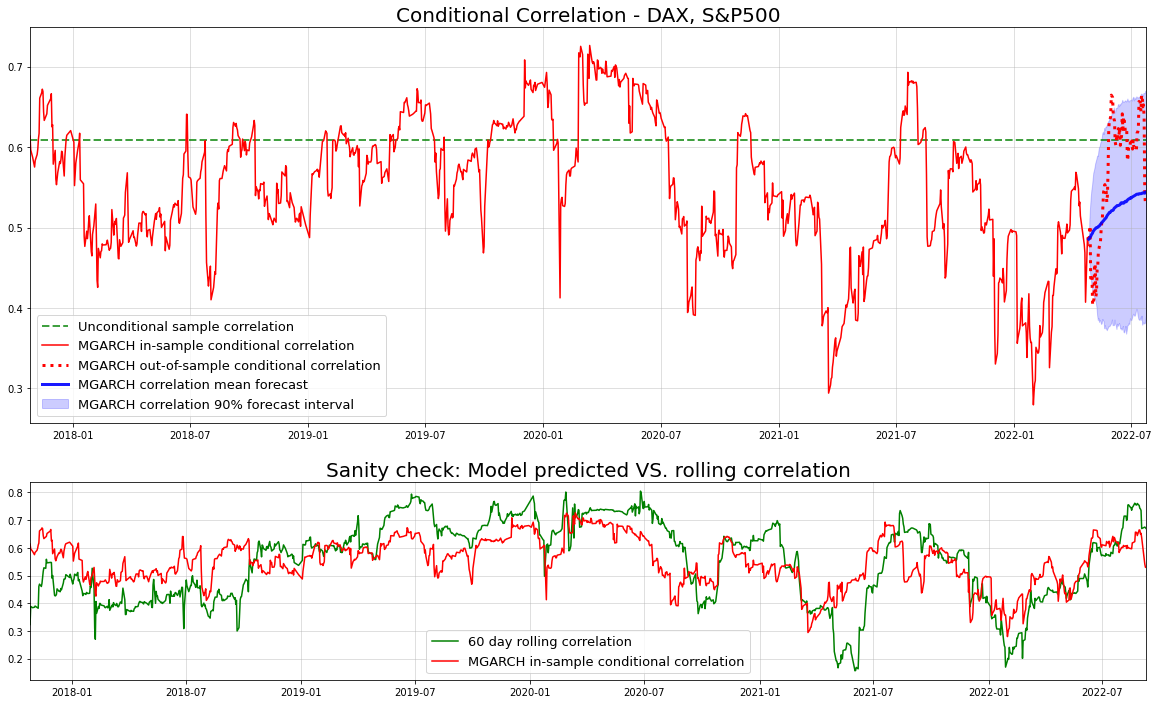

fig, axs = plt.subplots(2,1,figsize=(20,12), gridspec_kw={'height_ratios': [2, 1]})

axs[0].set_title("Conditional Correlation - DAX, S&P500", size=20)

axs[0].axhline(np.corrcoef(returns.T)[0,1], c="green",alpha=0.75,ls="dashed",lw=2, label="Unconditional sample correlation")

axs[0].plot(idx_train[30:],conditional_correlations[30:-90],c="red", label="MGARCH in-sample conditional correlation")

axs[0].plot(idx_test,conditional_correlations[-90:],c="red",ls="dotted",lw=3, label="MGARCH out-of-sample conditional correlation")

axs[0].plot(idx_test, corr_means,color="blue",lw=3, alpha=0.9, label="MGARCH correlation mean forecast")

axs[0].fill_between(idx_test, corr_lowers, corr_uppers, color="blue", alpha=0.2, label="MGARCH correlation 90% forecast interval")

axs[0].grid(alpha=0.5)

axs[0].legend(prop = {"size":13})

axs[0].margins(x=0)

axs[1].set_title("Sanity check: Model predicted VS. rolling correlation",size=20)

axs[1].plot(returns.index[30:],gdaxi_sp500_rollcorr.values[30:],c="green", label="60 day rolling correlation")

axs[1].plot(returns.index[30:],conditional_correlations[30:],c="red", label="MGARCH in-sample conditional correlation")

axs[1].grid(alpha=0.5)

axs[1].legend(prop = {"size":13})

axs[1].margins(x=0)