#!pip install "git+https://github.com/SaremS/side-projects.git#egg=stochastic_volatility_model&subdirectory=stoch-vola/model"title: “Stochastic Volatility model in C++ (using pybind11)”

import yfinance as yf

import pandas as pd

import numpy as np

import matplotlib.pyplot as plt

from findiff import FinDiff

from stochastic_volatility_model import StochasticVolatilityModeltickers = ['^DJI']

# Download the data from yfinance

df = yf.download(tickers, start="2022-01-01", end="2024-10-25")

dfp = df["Adj Close"]

dfr = np.log(dfp).diff().dropna()

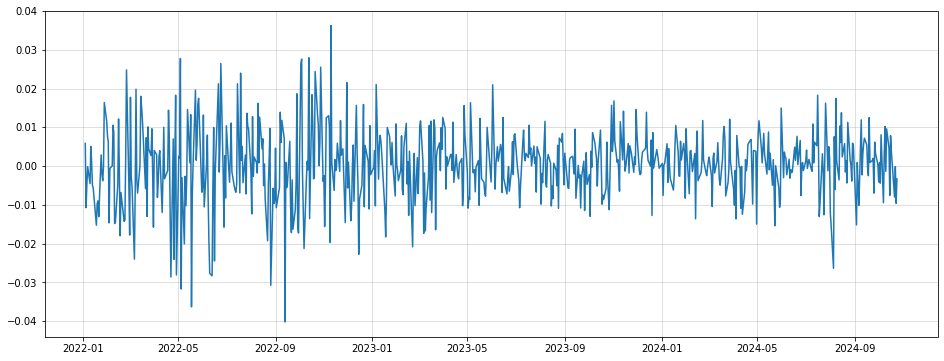

plt.figure(figsize = (16,6))

plt.plot(dfr)

plt.grid(alpha=0.5)[*********************100%***********************] 1 of 1 completed

from scipy.stats import norm

class RandomVolatility:

def __init__(self, alpha, beta, sigma):

self.alpha = alpha

self.beta = beta

self.sigma = sigma

def particle_filter(self, y, M=100, seed=321):

np.random.seed(seed)

T = len(y)

alpha = self.alpha

beta = np.tanh(self.beta)

q_sigma = np.exp(self.sigma)

particles = np.random.normal(size=(T+1,M)) * q_sigma

for t in range(1,T+1):

q_mus = alpha + beta * (particles[t-1,:] - alpha)

particles_t = np.random.normal(size=(M,))*q_sigma + q_mus

particles[t,:] = particles_t

obs_dists = norm(loc=0.0, scale=np.exp(particles_t/2))

w_t = obs_dists.pdf(y[t-1])

w_t = w_t/np.sum(w_t)

a_t = np.random.choice(np.arange(M),M,p=w_t,replace=True)

particles = particles[:,a_t]

return particles[1:,:]

def particle_filter_ll(self, y, M=100, seed=123):

particles = self.particle_filter(y, M, seed)

obs_dists = norm(loc=0.0, scale=np.exp(particles/2))

like = obs_dists.pdf(y.reshape(-1,1)).mean(1)

like[like==0] = np.min(like)

return np.log(like).mean()

%%time

##Python

RandomVolatility(np.log(np.std(dfr.values))*2, 5.0, 0.0).particle_filter_ll(dfr.values,M=100)CPU times: user 593 ms, sys: 8.88 ms, total: 602 ms

Wall time: 604 ms3.428327859504868%%time

##C++

StochasticVolatilityModel(np.log(np.std(dfr.values))*2, 5.0, 0.0).logLikelihood(dfr.values,100,321)CPU times: user 79.3 ms, sys: 2.11 ms, total: 81.4 ms

Wall time: 82 ms0.17236234874419082from scipy.optimize import minimize

dfrv = dfr.values

xn = np.array([np.log(np.std(dfr.values))*2, 5.0, 0.0])

result = minimize(lambda x: -StochasticVolatilityModel(*x).logLikelihood(dfrv,100,321), xn)parts = StochasticVolatilityModel(*result.x).particleFilter(dfrv,1000,123)

ps = parts.getParticles()means = np.mean(np.exp(np.array(ps)/2),1)

lower = np.quantile(np.exp(np.array(ps)/2),0.05,1)

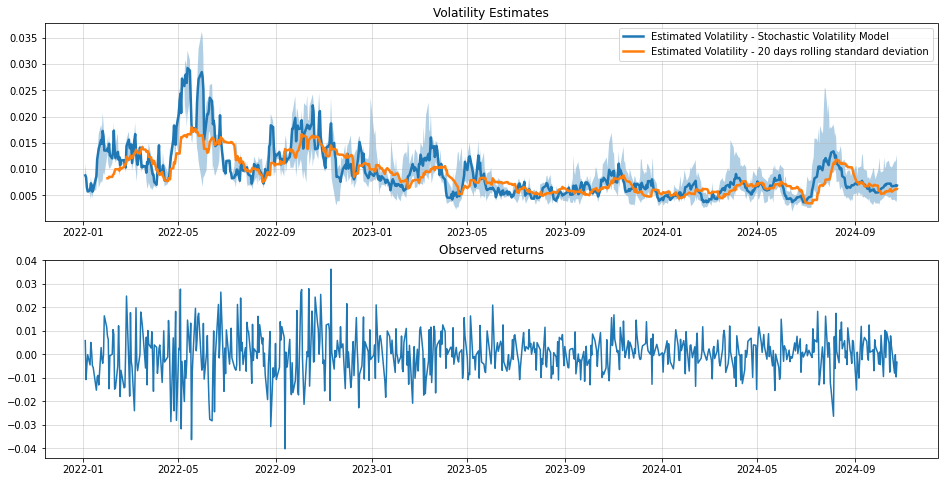

upper = np.quantile(np.exp(np.array(ps)/2),0.95,1)fig, axs = plt.subplots(2, 1, figsize=(16, 8))

axs[0].set_title("Volatility Estimates")

axs[0].plot(dfr.index, means, lw=2.5, label="Estimated Volatility - Stochastic Volatility Model")

axs[0].grid(alpha=0.5)

axs[0].fill_between(dfr.index, upper, lower,alpha=0.35)

axs[0].plot(dfr.rolling(20).std(), lw=2.5, label="Estimated Volatility - 20 days rolling standard deviation")

axs[0].legend()

axs[1].set_title("Observed returns")

axs[1].plot(dfr, label="^DJI")

axs[1].grid(alpha=0.5)